Federal tax calculator 2023 paycheck

Estimate your 2022 Return first before you e-File by April 15 2023. The payroll tax rate reverted to 545 on 1 July 2022.

2022 2023 Tax Brackets Rates For Each Income Level

Ad Compare Prices Find the Best Rates for Payroll Services.

. Students do not repay Federal Pell Grants so award increases can have a massive. Know your estimated Federal Tax Refund or if you owe the IRS Taxes. Sage Income Tax Calculator.

The Tax Calculator uses tax. The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in. Welcome to the FederalPay GS Pay Calculator.

Let us know your questions. Use this calculator for Tax Year 2022. IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld.

Our 2022 GS Pay. And is based on the tax brackets of 2021. Estimate garnishment per pay period.

Use SmartAssets paycheck calculator to calculate your take home pay per. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Subtract 12900 for Married otherwise. It is mainly intended for residents of the US. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Federal Taxes Withheld Through Your Paychecks. Compare options to stop garnishment as soon as possible. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees.

ICalculators Australia Tax Calculator provides a good example of income tax calculations for 2023 it includes historical tax information for 2023 and has the latest Australia. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 2021 Tax Calculator Exit. Based on the Information you entered.

Calculate Your 2023 Tax Refund. Estimate your federal income tax withholding. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Estimate your federal income tax withholding. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

One of the most important FAFSA 2023-24 changes could be the Pell Grant eligibility. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Prepare and e-File your. 2022 Federal income tax withholding calculation. Enter your filing status income deductions and credits and we will estimate your total taxes.

Ad Takes 2-5 minutes. All Services Backed by Tax Guarantee. Based on your projected tax withholding for the year we can also estimate your tax refund or.

It can also be used to help fill steps 3 and 4 of a W-4 form. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. Effective tax rate 172.

Make Your Payroll Effortless and Focus on What really Matters. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Your household income location filing status and number of personal.

The same goes for the next 30000 12. UK PAYE Tax Calculator 2022 2023. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Use this tool to. The calculator will calculate tax on your taxable income only.

Discover Helpful Information And Resources On Taxes From AARP. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. This year you expect to receive a refund of all.

SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. See how your refund take-home pay or tax due are affected by withholding amount.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Calculator And Estimator For 2023 Returns W 4 During 2022

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Ready To Use Paycheck Calculator Excel Template Msofficegeek

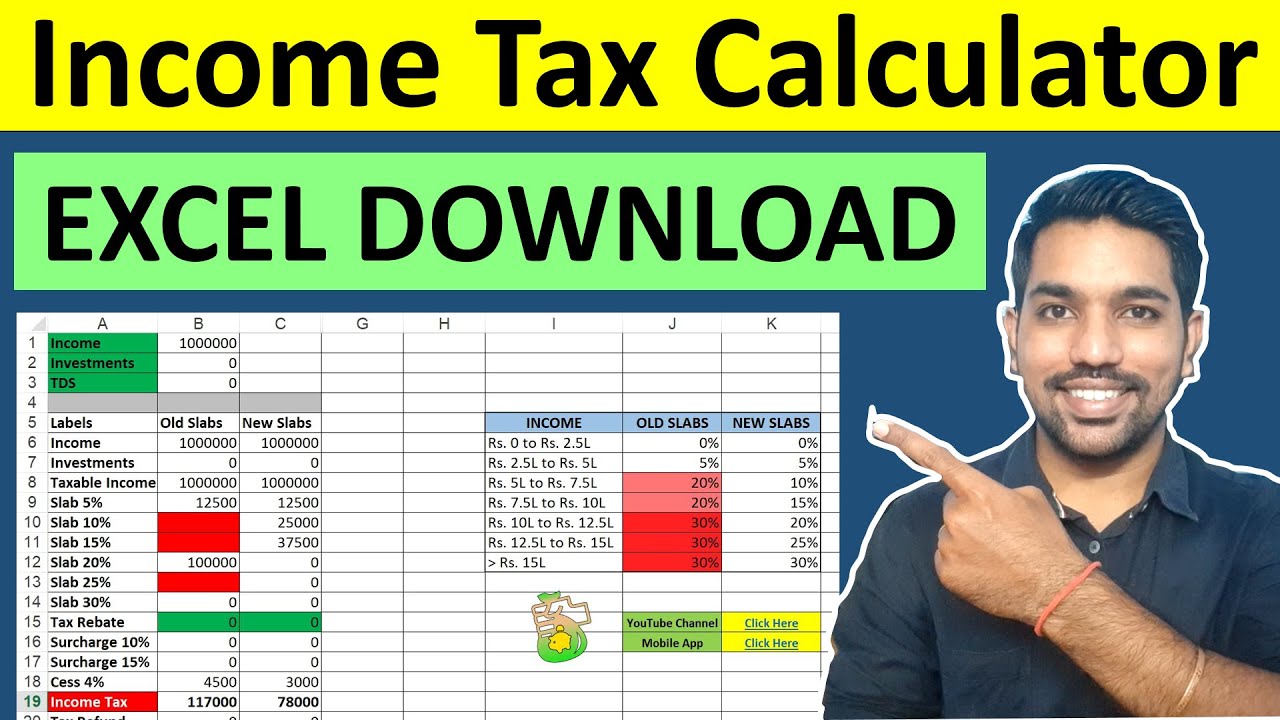

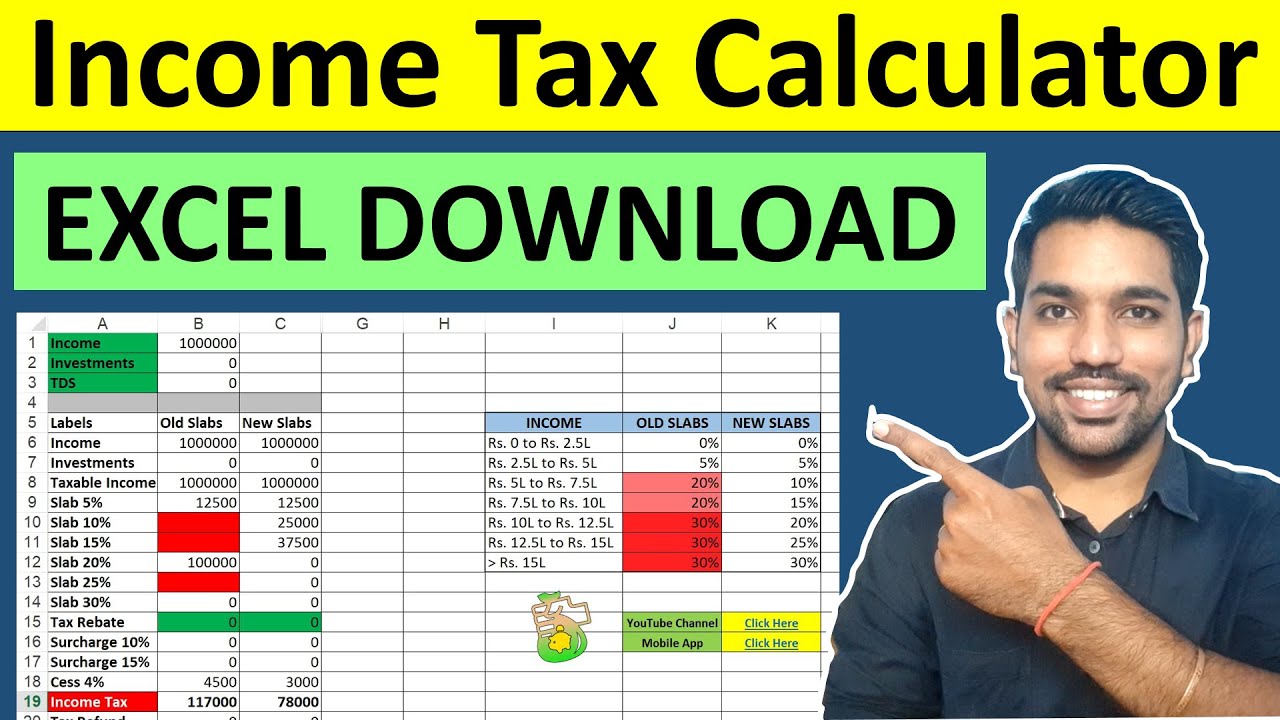

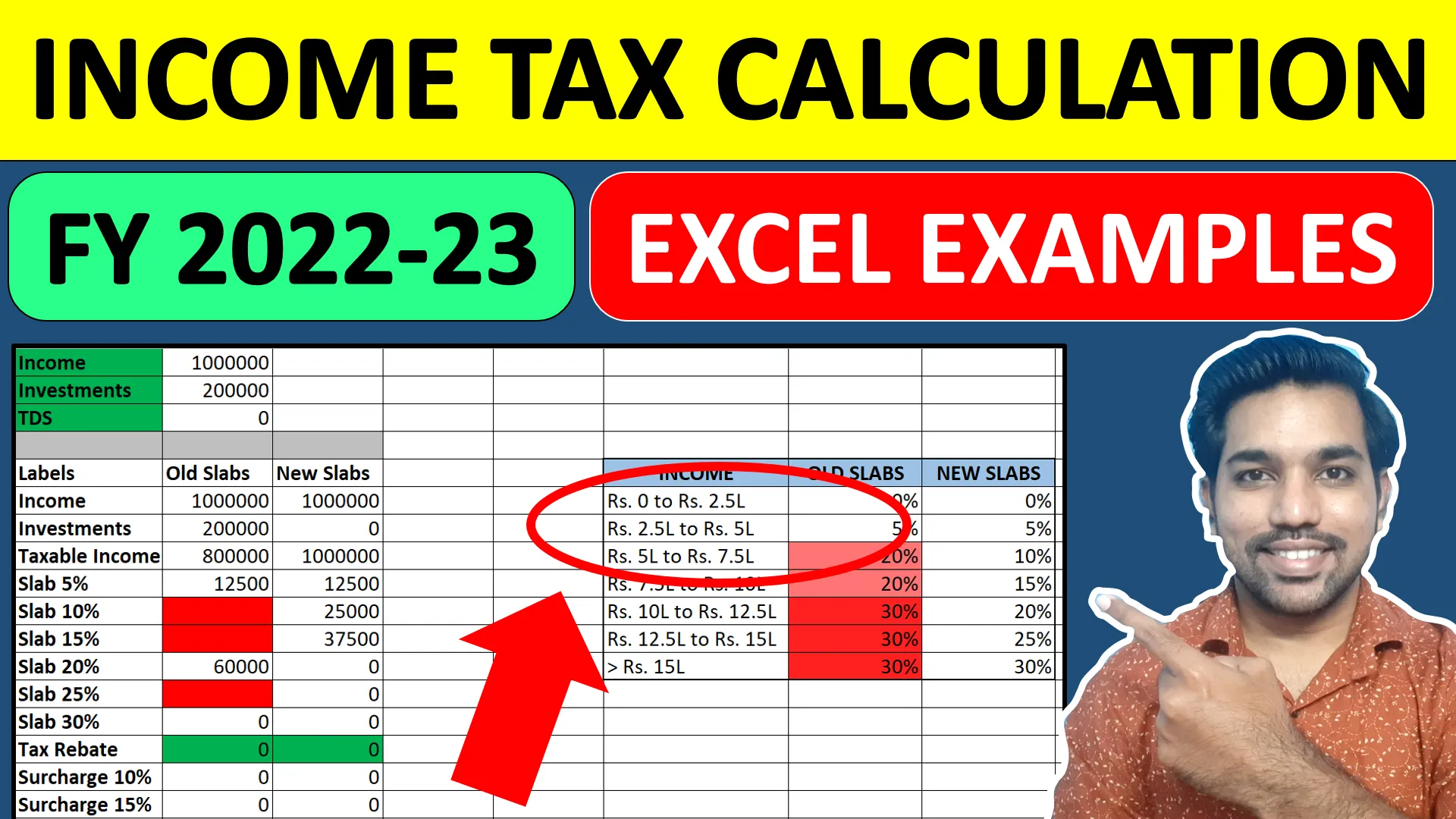

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Income Tax On Salary With Example In Excel Fincalc Blog

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube