Paycheck tax calculator with overtime

For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Then enter the hours you.

. F B D. If the employee who earned 825 this week pays 1650. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The rate at which your employer will apply federal income taxes will depend. Federal payroll tax rates for 2022 are. Next divide this number from the annual salary.

Total annual income Tax liability. Overtime Hours per pay period Dismiss. In the Weekly hours field enter the number of hours you do each week excluding any overtime.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Thats where our paycheck calculator. C B PAPR.

Your estimated --take home pay. B A OVWK. Using an internet overtime tax calculator can make calculating tax easy but.

Calculating Overtime Paychecks. Please adjust your. If you do any overtime enter the number of hours you do each month and the rate you get paid.

D RHPR RHWK. Overtime pay per year. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Overtime Calculator More - Free. The first step in calculating tax is to remove any pretax deductions from the pay. Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages.

Overtime pay per period. This FREE business payroll tax calculator will help find out your employees taxes. The Overtime Formula The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

You cant withhold more than your earnings. First enter your current payroll information and deductions. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

For overtime you must enter your hourly rate then either enter the amount in the 1x 15x 2x boxes or the hours. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. You can enter your basic pay overtime commission payments and bonuses.

Withhold 765 of adjusted gross pay for Medicare and Social. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Regular pay per year.

It can also be used to help fill steps 3 and 4 of a W-4 form. E D PAPR. The overtime calculator uses the.

Get an accurate picture of the employees gross pay including. Total pay per period. Regular pay per period.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

California Paycheck Calculator Smartasset

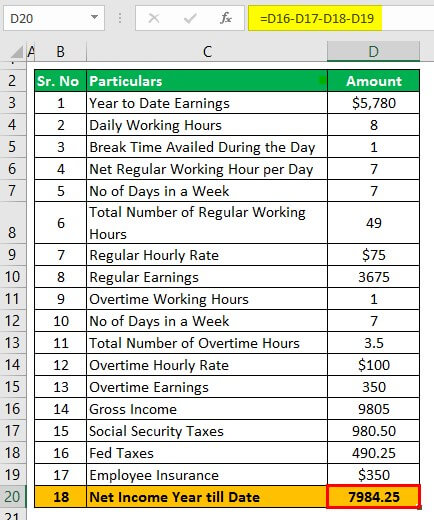

How To Calculate Net Pay Step By Step Example

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

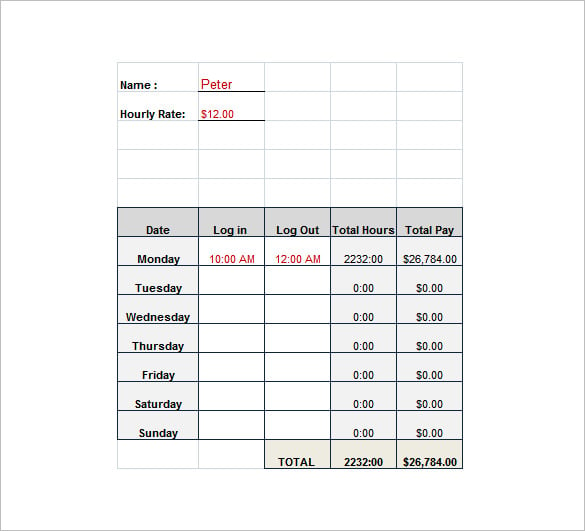

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Salary To Hourly Calculator

Free Payroll Tax Paycheck Calculator Youtube

Paycheck Calculator Take Home Pay Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly Paycheck Calculator Step By Step With Examples

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Calculator With Pay Stubs For Excel